Traditional open banking connections only show what consumers choose to share, while credit bureau data shows historical lending behaviour. For Credit Hire Organisations (CHOs) or Lenders who need to prove full affordability and impecuniosity, this creates critical gaps between historical credit data and real-time financial behaviour.

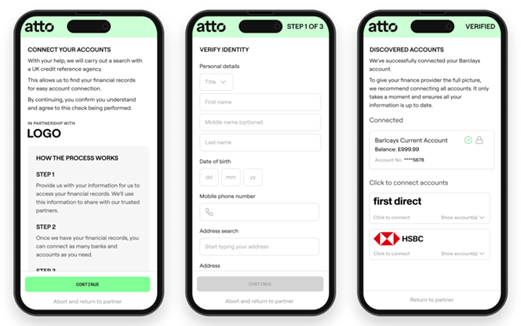

Atto Connect bridges these gaps by retrieving a consumer’s full account list directly from their credit file through TransUnion, then seamlessly prompting them to connect all eligible accounts via open banking. This closes the gap between historical credit data and real-time financial behaviour, providing the complete picture needed for confident decisions.